Business Debt Refinancing and Business Debt Restructuring are two common approaches to address financial challenges. While both options aim to alleviate a Business’ financial burdens, they involve distinct processes and have different implications for Businesses. In this comprehensive article, we will delve into the differences between Business Debt Refinancing and Business Restructuring, explore the scenarios where each is most appropriate, and provide insights into how Businesses can navigate these strategies and techniques effectively.

Mastering Business Cash Flow: Simple Solutions for Timely Payments

Maintaining a healthy cash flow is crucial for a successful Business. Late payments to accounts payable, vendors, and creditors can create significant challenges. Let’s review common reasons for Business Cash Flow issues, understanding the consequences of late payments, and provide straightforward strategies to address and prevent delays, ensuring a strong financial foundation for your business.

Understanding Why Cash Flow Stumbles

Customers Taking Too Long to Pay: When customers take a while to pay, it can cause cash flow issues. If your business gives customers a long time to pay, it can create problems meeting your own financial commitments….

Increase Business Cash Flow: Making Business Debt & Liability Repayment Easier

In Business, having flexibility in repaying of Business Debts & Liabilities is crucial for financial stability and growth. Let’s look at the advantages of extending the time you have to pay back loans and liabilities, how to go about it, and practical strategies for achieving financial stability.

The Benefits of Extending Business Debt and Liability Repayment Terms

More Cash Flow: Giving yourself more time to repay Business debts and liabilities helps a Company better manage day-to-day cash flow. It means you have more money available to cover everyday costs and respond to unexpected financial challenges…..(more)

Pitfalls of Merchant Cash Advances MCAs & Short-Term Business Debt

Merchant Cash Advances (MCAs) and Short-Term Business Debt options (less than 2-year payback period) have become a popular alternative financing option for Businesses seeking quick access to capital.

While Merchant Cash Advances MCAs and Short-Term Business Debt offer a streamlined application process and flexibility, it is crucial for Businesses to be aware of the potential dangers associated with this form of Business financing. Time to look at the risks and pitfalls of Merchant Cash Advances MCA and Short-term Business Debt, shedding light on the aspects that businesses need to carefully consider before opting for this financing solution.

Business Debt Swapping: Free up Business Cash Flow

n the dynamic landscape of Business Finance, finding effective solutions to optimize Business Cash Flow savings is essential for sustained success. One extremally viable strategy is Business Debt Swapping—an approach that involves reshuffling a company's existing debt to achieve better terms and, ultimately, free up cash flow. Let’s explore the concept of Business Debt swapping, delve into its benefits and challenges, and provide insights into how Businesses can leverage this strategy to enhance their financial flexibility and increase Business Cash Flow.

Understanding Business Debt Swapping

Business Debt swapping, also known as Business Debt Refinancing or one method of Business Restructuring, is a financial maneuver where a company reorganizes its existing Business Debt obligations to secure more favorable payment terms. This can involve negotiating with current Business creditors for extending repayment periods, or consolidating multiple debts into a single, more manageable obligation and payment over a longer term than the existing term. The primary goal of Business Debt swapping is to improve a business's financial position, increase cash flow, and enhance overall operational flexibility.

High Business Debt Payments Effect on your Company's Cash Flow: The Impact

Business Cash flow is the lifeblood of operations, and managing it effectively is crucial for long-term success. One of the factors that can significantly influence a Business’ Cash Flow is Business Debt, Loans & Merchant Cash Advance MCA. While taking on Business Debt can be a necessary part of running and growing a company, high Business Debt daily, weekly or monthly payments can have a substantial impact on your Company’s Cash Flow. In this article, we will explore the ways in which excessive and short-term Business Debt payments can affect your Cash Flow negatively and offer strategies to manage this challenge effectively…

Tackling Business Debt: Tips & Strategies

Unmanageable debt can cause significant stress and jeopardize the financial health of your company. Fortunately, there are strategies you can employ to regain control and navigate the turbulent waters of business debt. In this article, we will explore various approaches to manage unmanageable business debt payments effectively.

4 KEY STEPS TO GETTING BUSINESS DEBT UNDER CONTROL…(cont)

A Simple Guide to Business Restructuring: Making Your Business Better

When businesses want to make things work better, they sometimes do something called "business restructuring." It's like giving your business a makeover to improve how it runs. In this article, we'll talk about what business restructuring means, why businesses do it, and how they can make it happen.

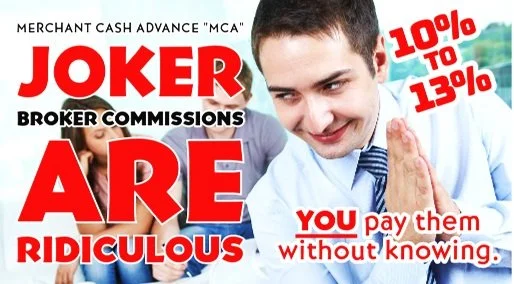

Beware of Bad Joker Brokers selling Merchant Cash Advance MCA and Short-term Business Loans: A Comprehensive Guide

Short-term (less than 2-yr payback period) Business Debt, Loans and Merchant Cash Advances (MCAs) can be a lifeline for small businesses in need of quick financing. However, not all Business Loans, Merchant Cash Advance MCA and MCA brokers are created equal.

While there are reputable brokers who connect businesses with responsible lenders, brokers that try to sell you Short-term Business Loans and Merchant Cash Advance MCA are far from reputable.

Let’s explore the world of bad Short-term Business Loan and Merchant Cash Advance MCA brokers, the risks they pose, and how business owners can protect themselves from their dubious practices.

Is more Business Debt the Solution to Cash Flow Issues?

Using more Business debt, loans or Merchant Cash Advance MCA to solve existing business debt and cash flow issues is not always the best or only solution, and it can be a risky strategy.

Business debt is a common aspect of business operations, with companies frequently relying on borrowed funds to fuel growth, invest in assets, manage cash flow, and navigate challenging financial periods. However, when businesses find themselves in a Business debt challenges, a pressing question often arises:

Mastering Business Debt Management: A Comprehensive Guide

Business debt is a double-edged sword in the world of Business financing. When managed effectively, it can serve as a valuable financial tool, helping companies expand, invest, and thrive.

However, mismanagement of business debt can lead to financial distress, insolvency and even bankruptcy. Let’s delve into the world of Business Debt Management, exploring its importance, strategies for effective management, and how to navigate challenging debt situations.

Where does all the Cash Flow go?

Lifeblood of your Business: The Importance of Business Cash Flow Management

Cash Flow is the lifeblood of any business, serving as a critical indicator of financial health and sustainability. For both established enterprises and startups, understanding and effectively managing cash flow is paramount. Let’s delve into the significance of business cash flow, exploring why it's crucial, the challenges it presents, how debt affects cash flow and how to maintain a healthy cash flow for long-term success.

Dangers of Short-Term Business Debt, Loans & Merchant Cash Advance MCA Financing: The Hidden Risks

In the world of Business finance, debt can be both a friend and a foe. While it often serves as a valuable tool to fuel growth and meet immediate financial needs, it can also become a double-edged sword, potentially leading to unforeseen financial challenges and dangers.

Short-term Business Debt, Loans & Merchant Cash Advance MCA in particular, presents a set of risks that every business owner should be aware of…

Strategic Business Debt Restructuring: A Step-by-Step-Guide

Strategic Business Restructuring: A Step-by-Step Guide

Creating a business restructuring plan is a crucial process for adapting to change, whether it's to cut costs, improve operations, prepare for growth or deal with business debt and cash flow issues…

Step-by-Step Guide on How to Refinance your Business Debt with an SBA Loan

SBA Loan Refinancing Checklist for Business Debt

1. Review Current Debt: Start by thoroughly examining your current business debt. Gather all relevant information, including the outstanding balances, interest rates, and repayment terms for each loan or debt obligation you wish to refinance…

20 Ways to Help your Business with Financial, Debt and Operational Challenges

Strategies for Helping your Business

Saving your business from financial, debt and operational challenges, or turning it into a more profitable venture can be a challenging but achievable endeavor. Here are several strategies to consider:

Guide to SBA Business Loan Refinancing and Debt Management for Small Businesses

Maximizing Financial Efficiency: A Guide to SBA Loan Refinancing and Debt Management for Small Businesses

Managing business debt is a common challenge faced by many small business owners, and seeking solutions to ease the financial burden is often a top priority. Fortunately, the U.S. Small Business Administration (SBA) offers several programs designed to provide relief and refinancing options for businesses. In this article, we will explore the world of SBA loan refinancing, SBA debt refinance programs, and the benefits they offer to small businesses.

Navigating Business Debt: Strategies for Business Loan Consolidation, Relief, and Refinancing

Understanding Business Debt

Running a business often means managing finances, and for many business owners, that includes dealing with business debt. While it's not uncommon to require financial assistance at various stages of a business's life cycle, managing debt efficiently is crucial. In this article, we'll explore strategies like business debt consolidation, business debt relief, and business refinance loans. We'll also delve into the world of Merchant Cash Advance (MCA) loans, the associated challenges, and potential solutions.