Short-term (less than 2-yr payback period) Business Debt, Loans and Merchant Cash Advances (MCAs) can be a lifeline for small businesses in need of quick financing. However, not all Business Loans, Merchant Cash Advance MCA and MCA brokers are created equal.

While there are reputable brokers who connect businesses with responsible lenders, brokers that try to sell you Short-term Business Loans and Merchant Cash Advance MCA are far from reputable.

Let’s explore the world of bad Short-term Business Loan and Merchant Cash Advance MCA brokers, the risks they pose, and how business owners can protect themselves from their dubious practices.

Role of MERCHANT CASH ADVANCE MCA Brokers

MCA brokers serve as intermediaries between small businesses seeking cash advances and the MCA lenders willing to provide funding. They can simplify the process for business owners by matching them with suitable lenders. This intermediary role can be highly beneficial when the broker is reputable and prioritizes the best interests of their clients.

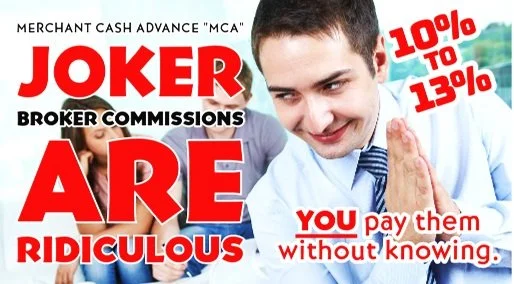

A majority of Brokers (we call them Joker Brokers) that push and sell Merchant Cash Advance MCA work for the MCA companies, NOT FOR YOU. These MCA Joker Brokers are paid by the Merchant Cash companies. 10% to 13% commissions on the capital that you borrow, is paid to a MCA joker broker at closing. A Business owner does not typically see this as the MCA company or Short-term Lenders pay these 1099-C commissions directly to the Joker Broker, and YOU PAY FOR IT IN THE COST OF THE FINANCING!

Most MCA joker brokers DO NOT have their clients' best interests at heart. They are only concerned with which MCA company or Lender pays them the highest commissions. Bad MCA joker brokers engage in unethical practices, placing business owners at risk by facilitating a financing transaction that the Business may very well not be able to afford to pay back. Here's a closer look at the warning signs and risks associated with unscrupulous MCA brokers:

Warning Signs of Bad MCA JOKER Brokers

1. Lack of Transparency:

Bad MCA joker brokers often operate with a lack of transparency. They may withhold important information about the terms of the advance, fees, and repayment conditions, making it challenging for business owners to make informed decisions by having all of the factors and risks to consider.

2. Exorbitant Fees, NOT ON YOUR SIDE:

Unscrupulous joker brokers may charge excessive fees for their services, often taking a substantial portion of the funds intended for the business owner. These fees can eat into the business's profitability and make the MCA less beneficial. These fees are paid directly to the Joker Broker from the MCA companies and short-term Lenders to which the joker brokers introduce you.

3. High-Pressure Sales Tactics:

Bad joker brokers use high-pressure sales tactics to persuade business owners into accepting an MCA without fully understanding the terms. They may employ aggressive approaches to secure a deal quickly.

4. Inadequate Due Diligence:

Reputable brokers conduct thorough due diligence to ensure that the Business Financing proposed is a suitable financing option for the Business. Bad joker brokers may skip this critical step, leading to business owners taking on debt they cannot afford.

5. Unethical Practices:

Some brokers engage in unethical practices, such as switching the terms of the agreement without the business owner's knowledge or consent, potentially leading to unexpected and unfavorable conditions. Also, “double funding” or arranging two MCA financing closings on the same day or within a few days of each other is another back-handed joker broker tactic that destroys Businesses.

6. Hidden Clauses and Penalties:

Bad joker brokers may not adequately explain the terms and conditions of the MCA agreement. This can result in business owners unknowingly accepting harsh clauses and severe penalties for late payments or early repayment.

7. Misleading Information:

Unscrupulous joker brokers may provide misleading information about the MCA's impact on the business. They might downplay the risks and paint an overly positive picture to secure a deal.

8. Poor Reputations:

Bad MCA brokers are often associated with negative reviews and complaints from Businesses they've worked with. Checking online reviews and seeking recommendations can help identify joker brokers and MCA Companies to avoid. Many MCA companies are sued by Business owners and State and Federal authorities for providing illegal loans that violate your state’s usury (interest rate cap) laws.

Risks of Dealing with Bad MCA JOKER Brokers

1. Financial Strain:

Working with a bad MCA joker brokers can result in financial strain for the business. Excessive fees, unfavorable terms, and inadequate due diligence can lead to unmanageable Business debt & liabilities.

2. Business Viability:

Unscrupulous joker brokers may lead business owners into MCAs that are not suitable for their business, potentially jeopardizing their company's viability.

3. Legal Issues:

Bad joker brokers might engage in unethical or illegal practices. This can lead to legal issues, potentially harming the business owner's reputation and financial stability.

4. Debt Cycles:

Accepting Merchant Cash Advances MCAs with unfavorable terms can trap businesses in debt cycles, making it challenging to escape the financial burden.

5. Damage to Credit:

Defaulting on Merchant Cash Advance MCA payments can harm a Business owner's personal and business credit scores, making it difficult to secure financing in the future.

Protecting Your BUSINESS from Bad MCA JOKER Brokers

Business owners can take steps to protect themselves from bad MCA joker brokers and their dubious and unethical practices:

1. Due Diligence:

Thoroughly research your broker before working with them. Check their credentials, read online reviews, and ask for recommendations from trusted sources. Good financing deals that help a Business grow and succeed do not come to you. One must seek out reputable Lenders.

2. Transparency:

Demand transparency from the joker broker. Insist on a clear explanation of the terms, fees, and repayment conditions associated with the Merchant Cash Advance MCA.

3. Understand the Agreement:

Read and understand the MCA agreement thoroughly. If there are terms or clauses you do not fully grasp, seek clarification from the joker broker or your legal counsel.

4. Consult Legal & FINANCIAL Advisors:

Consider consulting with legal and Financial advisors before signing a Merchant Cash Advance MCA agreement. They can provide insights and advice based on your specific situation.

5. Trust Your Instincts:

If something feels off or too good to be true, trust your instincts. Avoid joker brokers who appear untrustworthy or employ high-pressure sales tactics.

6. Negotiate Terms:

If you believe that the terms of the MCA can be improved, don't hesitate to negotiate with the broker or the lender. Reputable brokers should be willing to work with you to secure better terms.

7. Report Unethical Practices:

If you encounter unethical practices from an MCA joker broker, consider reporting them to relevant authorities or industry watchdogs to protect other businesses from falling victim to their actions.

While reputable brokers can be valuable allies in securing Business financing, bad MCA joker brokers pose substantial risks to Business owners. Recognizing the warning signs, understanding the potential risks, and taking proactive steps to protect your business are essential to avoid falling victim to the dubious practices of unscrupulous MCA joker brokers. By being cautious and informed, Business owners can make better financial decisions and safeguard their Company's financial health.