“Debt gives you the ability to look like you're winning when you're not.”

-- Benjamin Franklin

Beware of Easy-to-Get Business Debt that Comes with Payments You Likely Cannot Afford

The landscape of business financing has evolved significantly in recent years, offering an expanding array of options beyond traditional bank loans.

The rise of online lenders and alternative financing solutions has made capital more readily accessible to small businesses, often with streamlined application processes and quicker funding times.

This ease of access, however, can mask the potential dangers lurking within certain types of business debt, particularly when the speed and simplicity of acquisition overshadow a thorough evaluation of the associated costs and repayment obligations.

While the promise of quick cash can be alluring, especially for businesses facing immediate financial needs, it is crucial for business owners to exercise caution and critically assess whether the debt they are considering comes with repayment terms that their business can realistically afford.

This report will delve into the characteristics of these "easy-to-get" forms of business debt, explore the reasons why businesses might be tempted to take them on, highlight the severe consequences of default, and provide guidance on how businesses can make informed borrowing decisions and build a more sustainable financial future.

Decoding "Easy" Business Debt: Types and Characteristics

The term "easy-to-get" business debt often refers to financing options that have less stringent qualification requirements and faster approval processes compared to traditional bank loans or Small Business Administration (SBA) loans.

Several types of Business financing fall into this category, each with its own set of characteristics…

Merchant Cash Advances (MCAs) - Sale of Future Receivable

Merchant Cash Advances (MCAs) represent a unique form of financing that is technically not a loan but rather an advance on a company’s (or merchant’s) future sales or receivable.

The provider offers a lump sum of cash upfront, which is then repaid through an agreed-upon percentage of the company's daily or weekly sales or revenue deposits, plus a predetermined fee.

The amount of the advance is typically determined by a percentage of the business' revenue and top-line cash flow, rather than traditional credit scores or overall ability to service the business debt.

This repayment mechanism, directly tied to revenue, can appear flexible, and is suppose to be subject to adjustment as a MCA is not a loan and there is no fixed payment. There is an estimated payment.

However, during periods of slow sales, the fixed percentage deduction can create a significant strain on cash flow, potentially prolonging the repayment period and presenting challenges to liquidity.

MCAs often appeal to businesses with immediate cash flow needs or those that might not qualify for conventional loans due to factors such as lower credit scores or a lack of substantial collateral.

Short-Term Business Loans

Short-term business loans are characterized by their repayment terms, which typically range from a few months to approximately two years.

These loans generally provide a business with a lump sum of capital at the outset.

Online lenders frequently offer short-term loans with qualification criteria that are less demanding than those of traditional banks, although this accessibility often comes at the cost of higher interest rates.

Some short-term financing options, such as business lines of credit offered by companies like Fundbox and Bluevine, provide access to revolving funds up to a specified credit limit. Although, each draw is paid back typically on a 12-month payback period (amortization).

While short-term loans can offer a quicker route to obtaining funds compared to longer-term financing, their abbreviated repayment schedules necessitate larger and more frequent payments. This can put a considerable burden on a company’s regular cash flow if not meticulously planned for.

High-Interest Online (“Fintech”) Business Loans

High-interest online loans are primarily offered by online lending platforms and are notable for their rapid approval and funding processes.

While the speed and convenience of these loans can be attractive, they are frequently associated with significantly higher interest rates when compared to loans from banks or guaranteed by the SBA.

Lenders offering these types of loans may have more lenient requirements regarding credit scores but often compensate for the increased risk by charging higher rates.

The ease with which businesses can obtain these loans can be misleading, as the long-term financial implications of very high interest rates and accelerated payback periods can lead to a cycle of business debt that is difficult to break, especially if the fundamental financial challenges of the business remain unaddressed.

The Hidden Costs: Unpacking Interest Rates, Fees, and Repayment Structures

Understanding the true cost of "easy-to-get" business debt requires a careful examination of the associated interest rates or effective APR, fees, and repayment structures, which can often be more complex and expensive than they initially appear.

Merchant Cash Advances (MCAs) - Sale of Future Receivable

Merchant Cash Advances typically do not use traditional interest rates. Instead, they employ a "factor rate," usually expressed as a decimal ranging from 1.1 to 1.5.

To calculate the total repayment amount, the business multiplies the advance amount by this factor rate. For instance, a $50,000 advance with a factor rate of 1.4 would necessitate a total repayment of $70,000, implying $20,000 in fees.

While the factor rate might seem modest, the equivalent Annual Percentage Rate (APR) for MCAs can be exceptionally high, often falling within the range of 60% to 350% or even exceeding this in some cases.

This high APR is a consequence of the factor rate, additional fees, and the typically rapid repayment schedule.

Common fees associated with MCAs can include administrative, underwriting, and origination fees, further increasing the overall cost of borrowing.

Repayment is commonly structured as a daily or weekly deduction of a fixed percentage of the company’s top line sales or future revenue.

The frequent withdrawals can significantly impact a company's cash flow and liquidity, especially during slower sales periods.

The seemingly low factor rate can be deceptive, as many businesses fail to convert it into an equivalent APR, thus underestimating the true cost of the advance. Coupled with the frequent repayment demands, this can severely restrict a company's operational cash availability.

Short-Term Business Loans

Short-term business loans typically quote an Annual Percentage Rate (APR), which is a more comprehensive measure of the borrowing cost as it includes both the interest rate and any additional fees associated with the loan.

The APRs for short-term loans offered by online lenders can vary widely, ranging from approximately 24.0% to as high as 99.9% or even more in some instances.

In addition to interest, these loans may also involve origination fees, which can range from 1% to 5% of the loan amount, further impacting the net funds received and the total cost of the loan.

A key characteristic of short-term loans is their relatively short repayment terms, often spanning from 6 to 24-months.

This shorter duration necessitates larger and more frequent payments compared to loans with longer terms, which can strain a company's cash flow and liquidity if not carefully managed.

The significant variation in APRs among short-term business lenders highlights the critical importance of comparing offers from multiple sources.

Businesses facing urgent funding needs might be tempted to accept the first offer they receive without realizing that they could potentially secure more favorable rates and terms by exploring other options.

High-Interest Online Business Loans

High-interest online loans are characterized by their exceptionally high APRs, which can often reach triple digits.

The fees associated with these loans can also be substantial, potentially including origination, underwriting, and administrative charges.

While repayment terms can vary depending on the lender's assessment of risk and the borrower's cash flow situation, they often tend to be shorter, leading to high payment obligations.

The elevated cost of these loans can rapidly diminish a company’s liquidity, making it increasingly challenging to break free from a cycle of business debt.

Businesses considering such financing should carefully weigh whether the immediate need for funds justifies the potentially devastating long-term financial burden.

If a business is already facing cash flow difficulties, taking on a loan with a very high interest rate is likely to exacerbate the problem, with interest payments alone consuming a significant portion of the revenue, leaving limited resources for other operational needs or future growth.

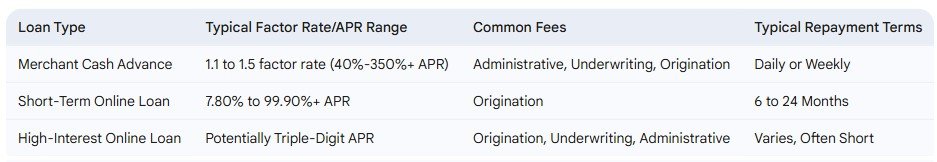

Comparing Business Financing Costs: An Overview

This comparison underscores the potentially exorbitant costs associated with certain types of readily accessible business debt, emphasizing the need for thorough evaluation before committing to such financing.

The Temptation Trap: Why Businesses Opt for High-Cost, Easy Debt

Despite the high costs and potential risks, businesses often find themselves drawn to these easy-to-get forms of debt for a variety of reasons.

Addressing Urgent Business Cash Flow Shortages

Businesses encountering immediate financial needs, such as meeting payroll obligations, covering unexpected expenses, or capitalizing on time-sensitive opportunities, might feel compelled to pursue the quickest available funding options, often prioritizing speed over cost.

For example, a business might require immediate capital to fulfill a substantial order or to acquire necessary inventory to meet demand. The pressure to resolve these urgent cash flow shortages can sometimes override a more measured assessment of the long-term affordability of the debt.

Lack of Awareness and Financial Literacy

A significant factor contributing to the uptake of high-cost, easy-to-get debt is a lack of comprehensive understanding regarding the intricacies of loan terms.

Many business owners may not fully grasp the distinction between a factor rate and an APR or the cumulative impact of daily repayments on their overall financial health.

Furthermore, the marketing of these financial products often emphasizes the ease and speed of access, potentially downplaying the total cost of borrowing.

This lack of financial literacy can make businesses vulnerable to accepting loan terms that are ultimately unsustainable.

Limited Access to Traditional Funding

Startups, businesses with less-than-perfect credit histories, or those lacking sufficient collateral might face challenges in qualifying for traditional bank loans or SBA-backed financing.

In contrast, online lenders frequently have more lenient qualification requirements, making their financial products accessible to a broader spectrum of businesses.

For businesses that have been denied funding by traditional institutions, these high-cost, easily accessible options might appear to be the only available lifeline, even if they carry substantial risks.

The Appeal of Speed and Simplicity

The application and approval processes for MCAs and online loans are often remarkably fast and require significantly less paperwork compared to the more rigorous procedures associated with traditional lending.

Businesses facing urgent funding needs or those that prefer a streamlined process might find this speed and convenience particularly appealing.

The promise of rapid access to capital can be a powerful motivator, especially in time-sensitive situations, potentially overshadowing the necessity for a thorough evaluation of the loan terms and the overall cost implications.

When the Payments come Due: Consequences of Defaulting on Unaffordable Debt

Defaulting on business debt, especially the "easy-to-get" but often high-cost variety, can have severe and far-reaching consequences for both the business and its owner.

Damage to Business and Personal Credit Scores

Failure to meet repayment obligations on any form of business debt, including MCAs and short-term loans, can severely damage your Company’s credit score.

This negative impact can make it considerably more difficult for the business to secure future financing at reasonable interest rates.

Moreover, many of these readily accessible loans, particularly MCAs and some online loans, often require a personal guarantee from the business owner.

In such cases, a default can also have a significant and detrimental effect on the owner's personal credit score.

The long-term ramifications of a damaged credit score can extend beyond mere loan applications, potentially affecting relationships with suppliers, landlords, and other crucial business partners.

Legal Ramifications

Lenders have the legal right to pursue various actions to recover outstanding debt, including initiating lawsuits and attempting to obtain court judgments against the defaulting business and potentially the owner if a personal guarantee is in place which can lead to forced business asset liquidation and seizure by the business creditor.

In the context of MCAs especially, as well as traditional lenders, funders frequently file a Uniform Commercial Code (UCC) lien, which serves as a public notice of their lien claim against the company's assets, potentially leading to the freezing of accounts receivable and payment processing services.

Furthermore, lenders may be able to seize business assets that were pledged as collateral or even the personal assets of the guarantor if a personal guarantee was provided.

Frozen Bank Accounts and Disrupted Operations

A particularly disruptive consequence of defaulting on an MCA is the potential for the funder to freeze the company's bank accounts and payment processors.

This action can severely impede a company's ability to conduct its daily operations, making it impossible to pay employees, suppliers, or other essential expenses, ultimately threatening the very survival of the business.

The immediate cessation of access to funds can create a rapid domino effect, potentially leading to the complete shutdown of the business, even if the initial default was triggered by a temporary downturn in revenue.

Business Failure and Bankruptcy

The combined impact of high-cost debt and the severe consequences of default can ultimately lead to the failure of the business, and if an out-of-court restructuring with a company’s creditors is unsuccessful, there may be a need to file for bankruptcy reorganization to continue operating under Chapter 11, Subchapter 5 and/or total liquidation and shutdown under Chapter 7.

While bankruptcy can offer a degree of financial relief, it also carries significant long-term implications for the company’s owners financial future and professional reputation.

Taking on business debt that is ultimately unaffordable can be a significant contributing factor to business failure, transforming a temporary cash flow problem into a permanent end to the enterprise.

The burden of excessively high interest payments can deplete a company's resources, preventing necessary investments in growth, adaptation to market changes, or the ability to withstand economic downturns, thereby significantly increasing the likelihood of failure.

Real-World Examples

Numerous instances illustrate the struggles businesses face with unaffordable, easy-to-obtain debt.

Many clients have entered into an MCA agreement where the funder was supposed to withdraw 14% of weekly sales deposits.

However, the funder instead took fixed amounts, exceeding the agreed percentage, and refused to adjust payments when the company's sales slowed.

This aggressive withdrawal drained the company's account, causing payments to bounce, and ultimately led to a filing of a civil lawsuit for breach of contract and the pursuit of the owner's personal guarantee of performance (not guarantee of payment).

This case demonstrates how some MCA agreements can be structured and executed in a way that puts significant financial strain on the borrower and presents high levels of risk to the company’s solvency and future operations.

Steering Clear of the Business Debt Trap: Advice and Resources for Businesses

To avoid the perils of easy-to-get business debt with unaffordable payments, businesses should adopt a cautious and informed approach to borrowing.

Conducting a Realistic Assessment of Borrowing Needs

Before seeking any financing, businesses should clearly define the purpose of the loan and how it will directly contribute to generating revenue or reducing costs.

It is crucial to calculate the anticipated return on investment (ROI) and ensure that it demonstrably exceeds the total cost of the debt overtime.

Businesses must also realistically determine the maximum amount they can afford to repay on a regular basis without jeopardizing their essential cash flow and operational stability.

Borrowing without a well-defined need and a clear plan for repayment is a significant risk.

Understanding and Comparing Loan Terms

Businesses must diligently compare offers from multiple lenders and thoroughly review and understand every aspect of the loan agreement, paying close attention to all fees and repayment terms.

When evaluating different business financing options, especially those involving factor rates, it is essential to always ask for the Annual Percentage Rate (APR) to facilitate an accurate comparison of the true cost of borrowing.

It is also important to look beyond the initial loan amount and carefully consider the total amount that will need to be repaid over the entire life of the loan.

Exploring Traditional and Alternative Funding Options

Businesses should prioritize exploring traditional funding avenues such as bank loans and SBA loans, as these typically offer lower interest rates and more favorable repayment terms for borrowers who meet their qualification criteria.

The SBA provides various loan programs, including 7(a) loans, 504 loans, and microloans, along with numerous resources to assist small businesses in accessing capital.

A business line of credit can also be a more flexible and potentially less costly option for managing short-term cash flow fluctuations.

Seeking Guidance from Financial Advisors and SBA Resources

It is highly advisable for businesses to consult with a qualified business financial advisor, accountants, or experienced business mentors before taking on any significant business debt.

The SBA and its network of partners, including Small Business Development Centers (SBDCs) and SCORE, offer free or low-cost counseling and training services to help business owners make informed financial decisions.

Identifying Red Flags of Predatory Lending

Businesses should be vigilant for warning signs of predatory business lending practices.

These can include lenders who pressure borrowers to sign agreements quickly, offer interest rates that are significantly higher than those offered by competitors, or impose fees that constitute an unreasonably high percentage of the loan value.

Borrowers should also be wary of lenders who ask them to provide false information on paperwork or leave signature boxes blank. A reputable lender should always be transparent about the APR and provide a complete payment schedule.

Building a Sustainable Future: Improving Cash Flow and Financial Planning

Reducing reliance on high-cost, easy-to-get loans requires businesses to focus on improving their underlying cash flow and implementing sound financial planning practices.

Strategies for Enhancing Business Cash Inflow

Businesses can improve their cash inflow by implementing strategies such as sending invoices promptly after a sale or service and offering incentives for customers who pay early.

It is also prudent to assess the creditworthiness of new customers and consider adjusting payment terms to shorten the collection cycle.

Diligent monitoring of accounts receivable and proactive follow-up on overdue invoices are essential.

Furthermore, businesses should strategically evaluate their pricing to ensure it aligns with market conditions and adequately supports healthy profit margins and cash flow.

Tactics for Optimizing Business Cash Outflow

Carefully analyzing all business expenditures and business debt payments to identify areas where costs can be reduced without negatively impacting essential operations is crucial.

Negotiating more favorable terms and payment schedules with suppliers can also help to optimize cash outflow.

Implementing efficient inventory management practices to avoid overstocking and tying up valuable cash is another important tactic.

Finally, businesses should consider leasing equipment instead of purchasing it outright to minimize large upfront cash expenditures.

The Importance of Financial Forecasting and Budgeting

Developing a comprehensive cash flow forecast that projects future income and expenses allows businesses to anticipate potential cash shortages and proactively address them.

Regularly creating and reviewing a detailed budget to track income and expenses can help identify areas for financial improvement.

Maintaining a sufficient cash reserve to cover unexpected expenses and emergencies is also a fundamental aspect of sound financial planning.

Conclusion: Empowering Businesses to Borrow Responsibly

In conclusion, while the accessibility of business debt has increased significantly, businesses must exercise considerable caution when considering "easy-to-get" financing options. Merchant Cash Advances (MCAs), short-term business loans, and high-interest online business loans, while offering the allure of quick capital, often come with high costs and repayment terms that can become unsustainable, leading to severe financial consequences.

The potential pitfalls include exorbitant interest rates or factor rates that translate to high APRs, significant fees, aggressive daily or weekly repayment schedules, and the severe repercussions of default, such as damaged credit scores, legal action, frozen receivables and processing accounts, bank account seizures, and ultimately, business failure.

To navigate this complex landscape, businesses must prioritize a thorough and realistic assessment of their borrowing needs, diligently compare loan terms with a focus on the APR, explore safer funding alternatives like traditional bank and SBA loans, seek guidance from financial professionals, and remain vigilant for red flags indicative of predatory lending practices. Furthermore, strengthening internal cash flow management and implementing robust financial planning strategies are crucial for reducing reliance on high-cost debt.

The increasing regulatory scrutiny at the state level, with more states enacting commercial financing disclosure laws, signals a growing awareness of the need to protect small businesses.

However, the primary responsibility lies with business owners to educate themselves, exercise due diligence, and prioritize long-term financial health over the immediate appeal of quick and easy, but potentially unaffordable, business debt.

By adopting a responsible and informed approach to borrowing, businesses can secure the capital they need for growth and sustainability without falling into the trap of debt they cannot afford.

We can help you Navigate through the Small Business Financing maze.

The sooner you act, the more options you’ll have.

Schedule a consultation today and take the first step toward saving your business and your future.

Remember, more business debt isn’t the answer. A more effective business strategy is.

Click to setup an introduction meeting to discuss your situation and next best steps.

Bernarsky Advisors

Business Finance and Strategy Advice

Refinance. Restructure. Reorganize.

(See more of our articles about Business Finance and Strategy below…)

WHAT IS THE BEST AND SAFEST WAY FOR YOUR BUSINESS TO DEAL WITH HIGH BUSINESS DEBT PAYMENTS?

It is NOT by stopping ACH payments.

It is NOT by taking on another business loan.

It is NOT ALWAYS a Refinancing

It is NOT by entering into a debt settlement program.

Find out the BEST strategies to get your Business back to where it was